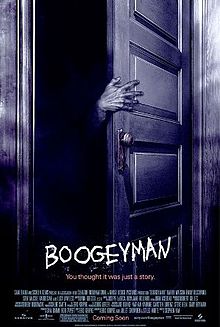

I realize some of you are scared of an imaginary credit card boogeyman. This stops you from applying for cards, which keeps you from getting bonuses, which prevents you from going on amazing vacations. I continue to tell people the Boogeyman doesn’t exist. If you have good credit and pay cards off every month, you have nothing to worry about. A month ago, I wrote a post called Attention: Wusses to try and shake the fear. I’m well aware that today’s post is going to freak some people out and create even more wussified behavior. Alas, I have no choice…

I heard from a friend and a couple readers this week who received the dreaded American Express Financial Review. What does this mean and what can you do about it?

- What is it? AmEx sends out a letter asking for information. The main thing they want is a copy of your tax return.

- What if I ignore it? You can have your American Express accounts shut down.

- Who gets it? All kinds of people. Some of the most common include those with huge limits on their cards, those who consistently charge over 50% of their credit limit, and those who go crazy with “alternative” things like Vanilla Reload cards.

- How can I be best prepared? The main thing is to not lie about your income when you apply for the card. If your tax return income matches the income you wrote on your application, you’ll be fine. If it’s a business card, you don’t need to pretend it makes a huge amount of money on your application. The truth shall set you free!