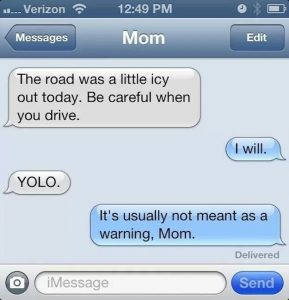

This one is going to be a mildly depressing post.

(Translation: you might punch your screen)

At the midway point of 2018, the following is my current situation with major banks. In short, this is (so far) the worst year I’ve ever had from a credit card bonus standpoint.

Chase:

Obviously, these are the guys for newbies to start with. As soon as you hit 5 or more credit cards from anywhere in a 24-month period…Chase is really, really not going to be your friend. So, at this point, I basically just get the leftover cards that are immune from that limitation. Not a ton there. Well, at least my last 3 months have been decent. I got 85,000 IHG points (because their new card product is still immune) and yesterday I was approved for the new Hyatt card (also currently immune). Make sure you read the terms for the latter (especially the first paragraph on the Offer Details page). If Chase wasn’t already a pain, multiple readers have had their accounts closed for various reasons – big spending, opening/closing too many cards, etc. Chase is tough.

Bank Of America:

These guys were closer to a sure thing than anything I’ve ever experienced. For a long time, the door was WIDE OPEN for me there. Not anymore. Like everyone else I talk to, I’m now limited to 4 Bank Of America personal cards per 24 months. So I haven’t had one for a while. The Business card side has been ok.

Barclays:

I haven’t been approved for a Barclays card yet in 2018. Not much happening for me there.

American Express:

They’ve also been known to shut down multiple readers. My last approval there…well…it wasn’t exactly a pleasant story. I’m not really applying for much there. This sounds like a pattern. A dumb one.

Citibank/US Bank/Others:

Scattered success. Nothing that exceptional.

Well, I warned you.

(This post = the MileNerd equivalent of watching an injured puppy limp sadly into the kitchen to his water bowl)

Have a great weekend, nerds!